When Strategy Meets Data Reality

For decades, strategic planning operated in cycles – annual offsites, multi-year roadmaps, budgets set once a year. But mid-to-large corporations now face a different landscape: volatile demand patterns, algorithmic competitors, supply-chain fragility, inflationary pressure, and customer expectations that shift in real time. In this environment, strategy can no longer rely on static assumptions or retrospective indicators.

Data has moved from being an input to becoming the operating system of strategy. Yet while nearly every leadership team proclaims commitment to “data-driven decision making,” few succeed in embedding data as a living spine of strategic planning. Many organizations are drowning in dashboards but starving for insight; they invest in tools yet continue to debate which numbers to trust. The resulting paralysis is not technological – it is strategic.

This article explores how corporations can move beyond dashboards and build a strategic planning discipline where data does not merely inform decisions but shapes strategic possibilities, guides resource allocation, and exposes blind spots early enough to matter.

Shift from Planning to Sensemaking

Traditional planning assumes that leaders can anticipate the future with a reasonable degree of certainty. But the pace of disruption has made foresight more probabilistic than predictive. As a result, planning is evolving into a discipline of sensemaking – continuously decoding signals from customers, markets, competitors, and internal operations.

This evolution places data at the center. But modern data is not just a record of what happened; it is a window into what may happen. Corporations that succeed in this shift treat data as a dynamic landscape to navigate, not a static truth to review.

One global logistics company recently redesigned its planning cycle around monthly “signal reviews” that blend operational data, customer feedback patterns, macroeconomic indicators, and competitor movements. Their strategic decisions – ranging from capex sequencing to market entry timing – are now anchored in a rolling, evidence-based architecture rather than an annual commitment. Within a year, forecast accuracy improved by 27% and the company avoided two major investments that would have been unviable six months later.

The lesson is simple: strategy becomes sharper when data shortens the distance between observation and action.

Data as a Governor of Strategic Choices

In many corporations, strategy discussions still hinge on intuition, hierarchy, and selective anecdotes. Data enters the room late – often to justify decisions already made. This undermines one of the most powerful roles data can play: governing strategic choices.

Consider three areas where data fundamentally reshapes leadership conversations:

1. Market Prioritization

Mid-to-large companies often expand based on legacy presence or leadership preference. But demand elasticity, wallet-share potential, customer profitability, and competitive intensity are quantifiable. A B2B industrial company we observed narrowed its growth focus from 14 priority segments to just four based on granular micro-market data. The shift freed up nearly 22% of growth capital, which was then redeployed to double market penetration in two chosen segments.

2. Capital Allocation

Data enables corporations to evaluate ROI not by historical norms but by forward indicators – pipeline velocity, digital adoption curves, cost-to-serve trajectories, and unit economics. Companies with strong data foundations can reallocate 10–20% of their annual budgets dynamically as new signals emerge.

3. Portfolio Strategy

Whether deciding to divest, acquire, or scale a business unit, data helps expose value pools clearly. Metrics like customer survival rates, margin volatility, and lifetime value provide a more grounded sense of which businesses deserve to grow and which are operationally dragging the enterprise.

In each case, data provides a counterbalance to human bias, allowing strategy to emerge not from preference, but from pattern recognition.

Unilever exemplifies this shift. Its global signal center synthesizes SKU-level consumption, commodity price movements, and sentiment data to detect shifts before they become visible in market reports. During the COVID-19 disruptions, this system identified a 38% surge in home-care and hygiene demand weeks before competitors adjusted. Unilever mobilized its manufacturing network and reallocated capital early, preserving margins during one of the most volatile periods in FMCG history.

Unilever exemplifies this shift. Its global signal center synthesizes SKU-level consumption, commodity price movements, and sentiment data to detect shifts before they become visible in market reports. During the COVID-19 disruptions, this system identified a 38% surge in home-care and hygiene demand weeks before competitors adjusted. Unilever mobilized its manufacturing network and reallocated capital early, preserving margins during one of the most volatile periods in FMCG history.

Why Most Corporations Still Struggle

The promise of data-driven strategy is seductive, but the reality remains challenging. Several recurring patterns explain why many organizations fail to translate data into strategic clarity:

Fragmented Ownership

Data often belongs to IT, while strategy belongs to the executive team. The absence of a unified “data-strategy architecture” leads to misalignment: strategy teams ask abstract questions, data teams deliver technical outputs, and insight is lost in translation.

Over-indexed Dashboards

Leaders frequently face an overload of retrospective dashboards – an illusion of insight that rarely reveals causal relationships or strategic implications. Volume becomes a substitute for clarity.

Inconsistent Data Quality

Strategic decisions crumble when underlying data is inconsistent, duplicated, or siloed. Without governance, even the best analytics tools produce contested truths.

Lack of Analytical Capability Among Business Leaders

Executives do not need to be data scientists – but they must understand analytical methods well enough to interpret signals and challenge assumptions. When leaders lack this fluency, data remains a technical resource rather than a strategic one.

Ultimately, most organizations don’t suffer from lack of data – they suffer from lack of data coherence.

Rise of the Strategic Data Layer

To bridge the gap, leading corporations are formalizing a Strategic Data Layer – a curated set of data assets, models, and insight mechanisms specifically designed to support strategy formulation.

Its characteristics typically include:

- Longitudinal data on customers, markets, and operations

- Forward-looking models (demand forecasting, churn risk, competitive scenarios)

- Unified taxonomies that standardize definitions across functions

- A central insight repository that evolves over time

- Playbooks that guide interpretation and decision-making

This layer is not a technology stack; it is an organizational capability. It allows the strategy team and business units to “speak the same data language,” eliminating interpretive friction.

![]() Walmart demonstrates this approach through its ZIP-code–level retail analytics across 4,700 stores. The company identified declining physical-store traffic patterns in specific micro-markets while e-commerce demand accelerated. Walmart closed 154 underperforming locations and redirected capital into last-mile logistics hubs, powering the Walmart GoLocal initiative. These decisions generated an EBIT uplift in targeted regions – evidence of how granular data transforms strategic decisions.

Walmart demonstrates this approach through its ZIP-code–level retail analytics across 4,700 stores. The company identified declining physical-store traffic patterns in specific micro-markets while e-commerce demand accelerated. Walmart closed 154 underperforming locations and redirected capital into last-mile logistics hubs, powering the Walmart GoLocal initiative. These decisions generated an EBIT uplift in targeted regions – evidence of how granular data transforms strategic decisions.

Asian Paints offers another compelling example. Its predictive demand engine incorporates retailer inputs, seasonality, historical patterns, and competitive intensity. By improving demand accuracy, Asian Paints reduced stockouts by 30% and freed 18 days of working capital – an operational outcome that directly shapes SKU strategy, market expansion, and distribution priorities.

Asian Paints offers another compelling example. Its predictive demand engine incorporates retailer inputs, seasonality, historical patterns, and competitive intensity. By improving demand accuracy, Asian Paints reduced stockouts by 30% and freed 18 days of working capital – an operational outcome that directly shapes SKU strategy, market expansion, and distribution priorities.

Data-Augmented Leadership: The Human Element

A common misconception is that better data results in automated or algorithmic strategy. In reality, it results in augmented leadership – where data empowers executives to ask deeper questions, test assumptions, and steer confidently through uncertainty.

Three shifts are particularly transformational:

From Opinion-Based to Evidence-Anchored Debate – Leadership conversations become more rigorous when participants interrogate scenarios with shared facts rather than persuasive anecdotes.

From Static Plans to Living Strategies – Data enables continuous recalibration. Plans evolve as new insights emerge, making strategy an adaptive discipline rather than a yearly ritual.

From Risk Avoidance to Risk Intelligence – Instead of fearing volatility, leaders can quantify it – modelling downside risks, early-warning signals, and resilience pathways.

In this sense, data does not replace judgment; it sharpens it.

UPS uses predictive routing models, capacity simulations, and long-term logistics ROI thresholds to evaluate expansion of its distribution network. Projects are approved only when models indicate a 19–22% long-run return. This discipline enabled more than $1.2 billion in capital efficiency gains between 2018 and 2022.

UPS uses predictive routing models, capacity simulations, and long-term logistics ROI thresholds to evaluate expansion of its distribution network. Projects are approved only when models indicate a 19–22% long-run return. This discipline enabled more than $1.2 billion in capital efficiency gains between 2018 and 2022.

Embedding Data Into the Strategic Planning Cycle

Corporations that fully integrate data into strategic planning tend to follow a structured rhythm:

1. Insight Discovery

Teams begin with a structured exploration of trends, anomalies, and evolving customer behaviors – not with budgets or targets. This shifts attention toward opportunity identification rather than constraint negotiation.

2. Hypothesis-Driven Strategy Development

Leaders convert insights into testable hypotheses. Data teams co-develop models to validate or refute these hypotheses, transforming strategy development into an iterative dialogue.

3. Scenario Modeling

Rather than rely on a single plan, companies build multiple scenarios with probabilities, triggers, and contingency pathways. Data enables the organization to treat uncertainty as a variable rather than a threat.

4. Resource Realignment

Investments follow insight, not history. Data reveals which initiatives deserve acceleration and which require re-evaluation.

5. Continuous Monitoring

A streamlined set of leading indicators acts as a strategic dashboard – allowing leadership to pivot confidently when early signals deviate.

When this rhythm matures, strategy becomes less of an annual event and more of a continuously informed capability.

Tata Steel applies a similar approach through cost-curve analytics, demand-supply projections, and geopolitical scenario models. When global energy inflation spiked beyond internal risk thresholds in 2022, the company strategically delayed capex expansions – preserving liquidity while the market absorbed shocks.

Tata Steel applies a similar approach through cost-curve analytics, demand-supply projections, and geopolitical scenario models. When global energy inflation spiked beyond internal risk thresholds in 2022, the company strategically delayed capex expansions – preserving liquidity while the market absorbed shocks.

The Cultural Equation: Trust in Data

No transformation of strategic planning is complete without a shift in culture. For data to influence decision making, organizations must trust it. That trust is built gradually through:

- Transparency of data sources

- Shared definitions across departments

- Rituals that reinforce data usage (e.g., “fact-forward meetings”)

- Leaders who model data curiosity

- Systems that minimize manual manipulation

In companies where this trust is cultivated, data becomes a democratizing force – the basis for open dialogue, meritocratic ideas, and collective problem-solving. In companies where it is absent, data becomes a source of conflict, and strategy remains a negotiation.

Netflix is a frontrunner in Strategic Data Layer (SDL) excellence. Its SDL integrates retention indicators, churn models, regional content-consumption patterns, and cost-to-produce analytics. This allows Netflix to greenlight or cancel content based not on surface-level viewership, but on long-term customer lifetime value and retention impact. The SDL transforms content decisions into strategic allocation decisions.

Netflix is a frontrunner in Strategic Data Layer (SDL) excellence. Its SDL integrates retention indicators, churn models, regional content-consumption patterns, and cost-to-produce analytics. This allows Netflix to greenlight or cancel content based not on surface-level viewership, but on long-term customer lifetime value and retention impact. The SDL transforms content decisions into strategic allocation decisions.

Mahindra Auto built its SDL by integrating dealer telemetry, digital-sentiment analysis, and competitive intelligence. This system guided Mahindra’s pivot to the SUV category, enabling the company to anticipate adoption curves and launch the XUV700 with high accuracy. The SDL became a strategic compass – aligning product design, capacity investment, and marketing execution.

Mahindra Auto built its SDL by integrating dealer telemetry, digital-sentiment analysis, and competitive intelligence. This system guided Mahindra’s pivot to the SUV category, enabling the company to anticipate adoption curves and launch the XUV700 with high accuracy. The SDL became a strategic compass – aligning product design, capacity investment, and marketing execution.

Looking Ahead: The Next Frontier of Data-Driven Strategy

As artificial intelligence and predictive analytics mature, corporations are entering a new era of strategic planning. Three developments will define the next decade:

1. Predictive Strategy Engines

AI will synthesize vast datasets to identify emergent opportunities and risks – effectively acting as an “early strategist” that surfaces patterns invisible to human intuition.

2. Dynamic Resource Allocation

Budgets will shift more fluidly, guided by real-time performance signals and probability-weighted outcomes.

3. Hyper-Personalized Decision Support

Executives will receive tailored strategic insights based on their role, context, and upcoming decisions – much like having a digital chief of staff.

But technology will amplify impact only in organizations that have already embraced the fundamentals: clean data, cross-functional alignment, and a disciplined planning rhythm.

Conclusion: Strategy as a Data-Informed Journey

For mid-to-large corporations, data is no longer an advantage; it is an expectation. The differentiator now lies in how effectively leaders can translate data into strategic clarity, agility, and conviction. The companies that outperform will be those that treat data not as a reporting asset but as a strategic asset – one that shapes decisions, reveals new possibilities, and builds resilience in an unpredictable world. When data becomes part of the strategic imagination – not just the operational engine – organizations unlock a new kind of intelligence: one where decisions are faster, sharper, and ultimately, more human.

______________________________________________________________________________________________________________________________

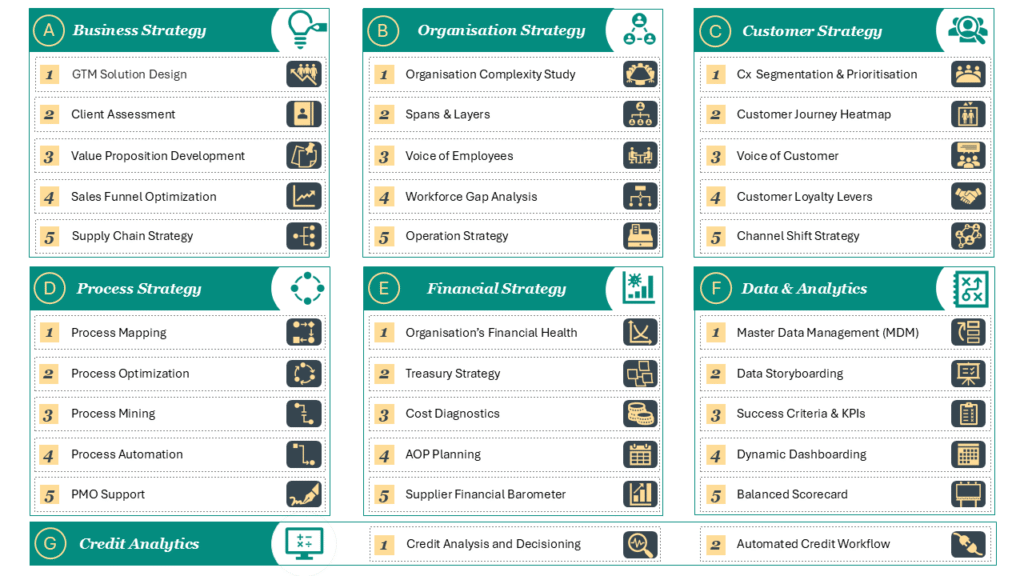

About Strategy Studio

At Strategy Studio, we help CXOs to solve complex business problems – from growth strategy and customer experience to financial transformation, process optimisation, and credit analytics. Our work blends rigorous analysis, practical execution, and deep functional expertise. To exlpore, schedule a free 30 minutes exploratory discussion HERE.

Other Articles

How to Assess Your Organization’s Financial Health for Strategic Growth

Why financial health has become a strategic constraint, not a reporting exercise Most organizations believe they understand their financial health

Cost Diagnostics: Identifying and Reducing Hidden Costs

Cost has returned to the centre of boardroom conversations, but not for the reasons many leaders assume. This is

Designing the Liquid Enterprise – Creating Organizations That Can Reconfigure Themselves in Real Time

For years, executives have described their organizations as “agile,” “adaptive,” or “responsive.” Yet in moments of disruption, many discover