Why financial health has become a strategic constraint, not a reporting exercise

Why financial health has become a strategic constraint, not a reporting exercise

Most organizations believe they understand their financial health because they can recite their revenue growth, margin profile, leverage ratio, and cash position. Boards review dashboards quarterly. CFOs publish detailed packs. Liquidity forecasts are refined monthly.

Yet when strategic inflection points arise – an acquisition opportunity, a downturn, a technology shift – many of these same organizations discover that their apparent financial strength does not translate into strategic flexibility.

The issue is not measurement. It is an interpretation.

Financial health, in the context of strategic growth, is not about historical performance. It is about the organization’s capacity to absorb volatility, redeploy capital, and sustain risk without destabilizing its operating model. Those capacities are rarely captured by headline metrics.

This distinction matters more now than at any point in the past two decades. Growth opportunities increasingly require front-loaded investment, tolerance for temporary margin compression, and resilience against macro uncertainty. Organizations that misread their financial health often discover their constraints precisely when ambition demands boldness.

The illusion of comfort in traditional metrics

Traditional financial analysis emphasizes profitability, liquidity, and solvency. These are necessary conditions for stability, but they are insufficient indicators of strategic readiness.

Consider operating margin. A healthy margin can signal pricing power or operational discipline. It can also conceal underinvestment. Organizations that protect margin aggressively may be deferring capability spending, leaving themselves exposed when competitive dynamics shift.

Similarly, a strong balance sheet can provide comfort while masking rigidity. Debt covenants, dividend commitments, and capital allocation precedents often restrict actual manoeuvrability far more than headline leverage ratios suggest.

In other words, financial health can appear robust while strategic elasticity is quietly deteriorating.

The uncomfortable implication is that financial stability and strategic readiness are not synonymous.

Cash flow tells a deeper story than earnings

If one metric deserves closer scrutiny in growth contexts, it is cash flow quality rather than earnings magnitude.

Earnings can be influenced by accounting policy, timing effects, and one-off adjustments. Cash flow exposes operational discipline. It reveals whether reported profitability converts into deployable resources or remains trapped in working capital, inventory build-up, or receivables concentration.

In capital-intensive sectors, such as infrastructure and manufacturing, organizations have historically reported strong order books and margin stability while experiencing chronic cash strain. The strain was not a failure of sales performance; it was a misalignment between contract structure, payment terms, and cost recognition.

For growth strategy, the question is not “Are we profitable?” It is “How much discretionary capital do we truly generate once obligations and structural reinvestments are accounted for?”

This distinction often forces difficult conversations about dividend policy, buyback programs, and growth promises made to investors.

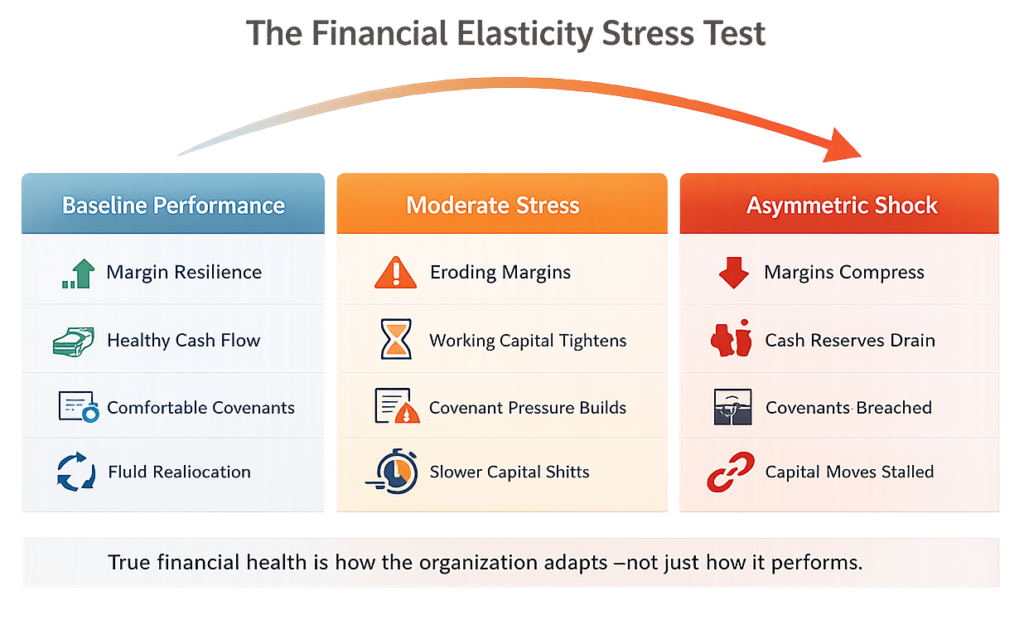

Balance sheet resilience under stress, not in normalcy

Many organizations assess financial health under baseline assumptions. Revenue projections follow moderate growth curves. Interest rates are modelled conservatively but optimistically. Risk scenarios are examined but rarely internalized.

A more revealing diagnostic tests balance sheet resilience under asymmetric stress: what happens if revenue falls 15 percent while input costs rise? How quickly can fixed commitments be adjusted? Which covenants tighten first? What secondary effects emerge on credit ratings and supplier confidence?

During periods of volatility, several well-capitalized firms discovered that their leverage ratios were manageable in isolation but became constraining once refinancing conditions deteriorated. The balance sheet was sound in normal conditions; it was fragile in transitional ones.

Growth amplifies financial design flaws

Strategic growth magnifies whatever weaknesses exist in financial architecture.

Rapid expansion exposes working capital inefficiencies.

Acquisitions reveal integration costs that were underestimated.

International scaling surfaces currency and tax exposures previously immaterial.

A consumer-facing multinational that expanded aggressively across emerging markets found that while revenue diversification improved top-line resilience, complexity in cash repatriation and local financing structures reduced effective liquidity at the group level. Growth created geographic spread but constrained capital agility.

This is the paradox: growth can strengthen scale while weakening financial coherence.

Assessing financial health for growth, therefore, requires examining whether the organization’s capital structure, funding sources, and allocation mechanisms can scale without introducing disproportionate fragility.

Case illustrations of strategic misread

In the years preceding its restructuring, a major European telecom operator maintained respectable EBITDA margins and stable subscriber growth. However, sustained capital expenditure commitments combined with spectrum auction obligations and high dividend payouts gradually eroded strategic flexibility. When competitive pressures intensified and regulatory shifts accelerated, management found itself with limited room to invest aggressively in next-generation infrastructure without jeopardizing balance sheet metrics. The constraint was not visible in a single quarter’s results; it was embedded in accumulated financial commitments.

Conversely, a global consumer health company that deliberately moderated shareholder distributions during periods of strong performance preserved optionality to pursue targeted acquisitions when sector valuations corrected. Its financial health was not defined by maximized short-term return but by maintained strategic discretion.

In both cases, headline performance obscured the more relevant question: how much choice did leadership retain?

What senior leaders must reconsider

Three assumptions often require unlearning.

First, that maximizing efficiency automatically maximizes health. Excessively optimized capital structures can leave no room for error. A degree of slack, while uncomfortable in performance reviews, can be the price of agility.

Second, that shareholder expectations are immutable. Leaders frequently underestimate their ability to reset expectations around capital allocation when framed within a credible long-term growth narrative.

Third, that finance’s role is to validate strategy rather than shape it. Assessing financial health for growth requires CFOs to challenge growth ambitions that outpace capital realism – and equally, to challenge conservatism that limits opportunity.

Financial health is not a scoreboard. It is a governance mechanism for ambition.

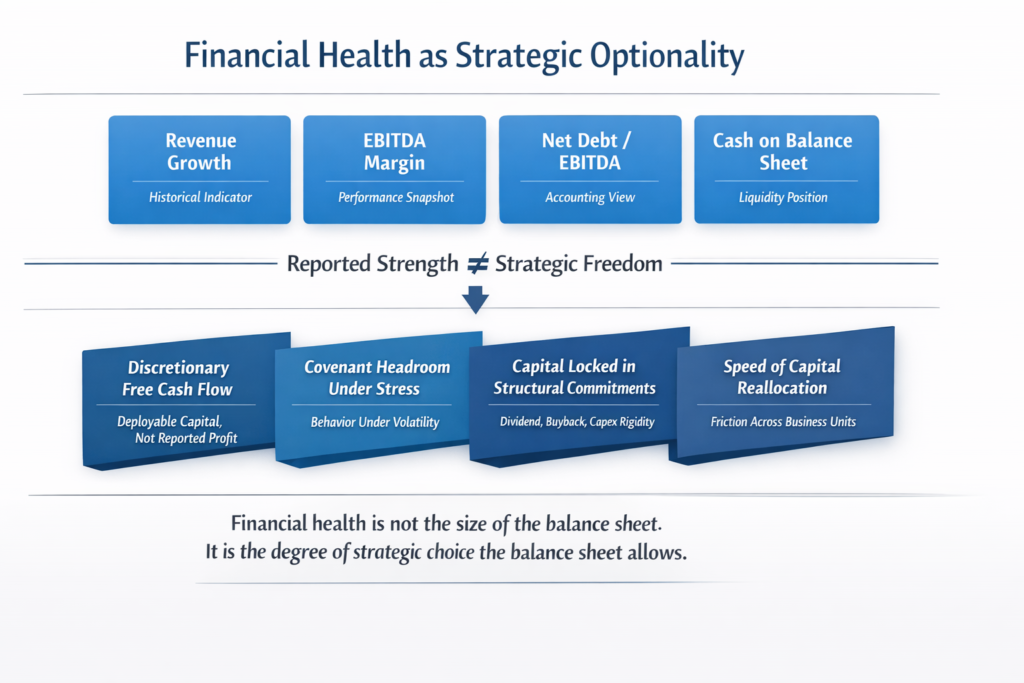

A reframing: Financial health as strategic optionality

A more useful mental model is to define financial health as the organization’s degree of optionality.

Optionality reflects:

- The ability to invest without destabilizing core operations

- The capacity to absorb volatility without breaching covenants

- The flexibility to pivot capital allocation when assumptions change

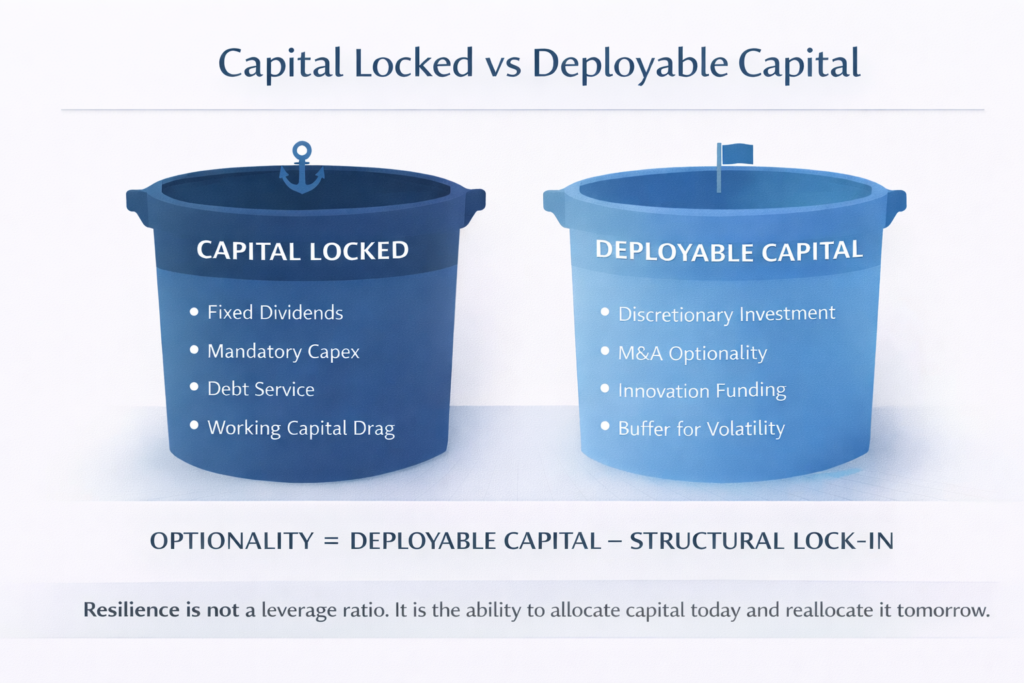

Optionality is eroded not only by leverage but by inflexible cost bases, rigid capital commitments, and cultural aversion to reallocation.

Under this framing, assessing financial health means mapping where capital is structurally locked versus genuinely deployable. It requires distinguishing between accounting profit and economic freedom.

Organizations that preserve optionality often appear conservative in the short term. Over longer cycles, they are disproportionately capable of strategic moves precisely when competitors are constrained.

What this means for large, complex organizations

For large enterprises, financial health is inseparable from operating complexity. Multiple business units, geographies, and funding sources create internal cross-subsidies that obscure true performance.

Assessing health requires transparency into which units generate surplus capital, which consume it, and how easily resources can move across boundaries. Without this clarity, growth initiatives risk being financed by fragile internal transfers rather than sustainable cash generation.

The structural consequence is that capital allocation discipline must be elevated from annual budgeting exercise to continuous strategic practice.

A closing perspective

Financial health is often described in reassuring terms: strong margins, stable leverage, predictable cash flow. In a more volatile era, reassurance is not enough.

The more relevant question is not whether the organization is financially stable today. It is whether it will remain strategically free tomorrow.

Assessing financial health for growth requires confronting trade-offs between short-term performance and long-term optionality, between visible returns and invisible resilience.

Organizations that mistake stability for strength may find their ambitions constrained when opportunity demands boldness. Those that understand financial health as the architecture of choice may discover that restraint today is what makes expansion possible tomorrow.

______________________________________________________________________________________________________________________________

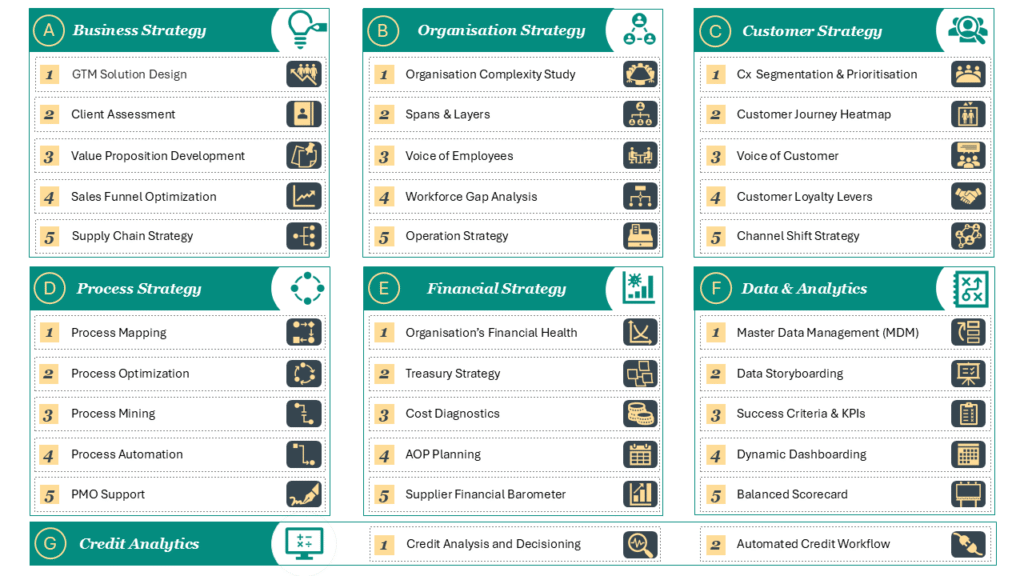

About Strategy Studio

At Strategy Studio, we help CXOs to solve complex business problems – from growth strategy and customer experience to financial transformation, process optimisation, and credit analytics. Our work blends rigorous analysis, practical execution, and deep functional expertise. To exlpore, schedule a free 30 minutes exploratory discussion HERE.

Other Articles

Cost Diagnostics: Identifying and Reducing Hidden Costs

Cost has returned to the centre of boardroom conversations, but not for the reasons many leaders assume. This is

Designing the Liquid Enterprise – Creating Organizations That Can Reconfigure Themselves in Real Time

For years, executives have described their organizations as “agile,” “adaptive,” or “responsive.” Yet in moments of disruption, many discover

AI-Ready Strategy Teams: The 2030 Tech Stack

Most strategy teams were built for a world that no longer exists. They were designed to synthesise reports, build