Cost has returned to the centre of boardroom conversations, but not for the reasons many leaders assume. This is not a familiar downcycle problem, where demand softens and temporary austerity restores margins. What is surfacing instead is a more uncomfortable realization: many organizations are carrying cost structures that no longer correspond to how value is actually created.

For years, growth absorbed inefficiency. Cheap capital, expanding markets, and tolerance for redundancy allowed organizations to accumulate layers, buffers, and coordination mechanisms without immediate consequence. Today, volatility exposes those choices. Costs that once appeared prudent now behave like fixed liabilities, resisting adjustment even as strategic priorities shift.

The issue is not that costs are too high in absolute terms. It is that cost has become decoupled from strategic intent.

The limits of traditional cost programs

Most cost initiatives still operate with an implicit assumption: that costs are discrete, visible, and reducible through managerial discipline. This assumption rarely holds in complex organizations.

Headcount reductions, procurement savings, and budget freezes address what is visible and measurable. They do little to alter the underlying mechanics that made those costs necessary in the first place. As a result, costs often reappear, redistributed rather than removed, embedded deeper into processes, governance, or external spend.

What these programs miss is that a significant portion of organizational cost is derivative. It exists not to create value directly, but to manage the consequences of prior design decisions: fragmented accountability, risk aversion encoded into processes, or decision rights that default upward.

When cost programs fail, it is usually because they target expense categories instead of organizational causality.

Hidden costs are rarely accidental

Hidden costs accumulate systematically. They are the predictable outcome of organizations optimizing locally while ignoring second-order effects.

Consider how complexity quietly manufactures cost. As businesses scale, leaders often respond to coordination challenges by adding roles, reviews, and controls. Each addition is rational in isolation. Collectively, they create an architecture that requires ever-increasing effort merely to function.

In several large enterprises that have undertaken internal cost diagnostics, analysis has shown that a meaningful share of indirect cost growth over time had no clear link to volume, regulation, or customer demand. Instead, it tracked increases in internal interfaces, approval layers, and exception handling. The organization had become more expensive simply to operate itself.

These costs are hard to see because no single function owns them. Finance observes the outcome. Operations feels the drag. Leadership experiences the friction. Responsibility remains diffuse.

Cost as a signal of organizational design quality

Every organization’s cost base encodes a set of design choices. Some are explicit. Many are not.

Where decision authority is unclear, organizations compensate with coordination.

Where trust is low, they compensate with controls.

Where accountability is fragmented, they compensate with oversight.

Over time, these compensations harden into structural cost.

This is why cost diagnostics must move beyond efficiency questions toward design questions. The relevant inquiry is not whether an activity is performed efficiently, but why it exists at all. Activities that manage internal uncertainty rather than external value creation are often the most expensive, precisely because they expand as complexity increases.

Seen this way, cost is not merely a financial metric. It is a proxy for unresolved organizational tension.

When cost reduction creates new costs

One of the more counterintuitive findings from rigorous cost diagnostics is that aggressive cost reduction can, paradoxically, increase long-term cost.

When headcount is removed without redesigning decision rights or operating boundaries, organizations respond by increasing escalation, reliance on external advisors, or informal coordination networks. The visible cost falls; the hidden cost rises.

A large industrial organization learned this the hard way after a broad-based SG&A reduction. While reported overhead declined, decision cycle times lengthened and project overruns increased. Within eighteen months, external spend and rework costs had erased much of the initial saving. The cost problem had not been solved; it had been displaced.

This illustrates a central principle of cost diagnostics: if the organization still needs the outcome, it will recreate the cost somewhere else.

A diagnostic approach to cost, not a reduction mindset

Strategic cost diagnostics start from a different premise. They assume that some costs are essential, some are misaligned, and others are artifacts of outdated design. The task is not to minimize cost universally, but to realign cost with value creation and risk exposure.

This requires examining cost through multiple, interconnected lenses:

- How decisions are made and escalated

- How work is structured across boundaries

- How risk is interpreted and controlled

- How resources are redeployed when priorities change

Viewed through these lenses, many “cost problems” reveal themselves as design debt: the cumulative cost of postponing structural decisions.

Importantly, this approach avoids the false trade-off between efficiency and capability. In many cases, simplifying decision architecture or clarifying accountability reduces cost while simultaneously improving speed and quality.

Illustrations from practice

When a global logistics provider examined rising overhead in its regional operations, the initial assumption was inefficiency. A deeper diagnostic revealed something more subtle. Regional leaders had limited authority to resolve commercial exceptions, leading to frequent escalations to central teams. The cost was not in the headcount itself, but in the volume of coordination required to move decisions through the system. Redesigning thresholds reduced both escalation and cost, without a traditional cost-cutting program.

In a regulated financial services institution, compliance spend had grown steadily despite stable regulatory requirements. Diagnostic work showed that controls had been layered over time to compensate for unclear ownership in the first line. Simplifying accountability reduced the need for duplicated reviews, lowering cost while improving risk clarity.

In both cases, cost reduction followed design correction, not the other way around.

What senior leaders must confront

Cost diagnostics often surface uncomfortable truths for leadership teams.

First, many hidden costs persist because they protect leaders from making explicit trade-offs. Ambiguity is expensive, but it is also politically convenient. Clarifying decision rights inevitably creates winners and losers.

Second, some costs endure because they signal seriousness. Large teams, extensive reviews, and multiple approvals can feel reassuring, even when they slow execution. Leaders must question whether reassurance is being purchased at the expense of adaptability.

Finally, leadership teams must accept that cost discipline is not a periodic exercise. In complex organizations, cost naturally drifts upward unless design is actively maintained.

A mental model for cost diagnostics

Most leadership teams instinctively start treating cost diagnostics as an accounting problem: something to be measured, allocated, and controlled. That framing is familiar, but it hides what cost actually represents in complex organizations. A more useful mental model is to see cost as the residual of unresolved organizational choices. The objective becomes not to cut cost, but to shorten the distance between intent and execution.

Whenever an organization avoids making a hard decision-about authority, accountability, risk tolerance, or operating boundaries-it pays for that avoidance over time. The payment rarely appears as a single line item. Instead, it accumulates through additional roles, layered reviews, compensating controls, and informal coordination that allow work to continue despite structural ambiguity.

In this sense, cost becomes a shadow system. It reflects not just what the organization does, but how clearly it has decided who decides, under what conditions, and with what consequences. Where clarity is high, cost remains contained. Where clarity is low, cost grows non-linearly, because the organization keeps buying certainty through effort rather than design.

This also explains why hidden costs are so persistent. Removing them forces leaders to confront the choices those costs are compensating for. Eliminating a review layer requires explicit risk appetite. Reducing coordination spend demands sharper interfaces. In both cases, cost falls only when ambiguity is resolved, not when pressure is applied.

Cost diagnostics, done well, surface where the organization is systematically paying to postpone decisions. Cost is not just something to be reduced. It is a diagnostic signal pointing to where the organization has stopped designing and started compensating.

Where complexity accumulates faster than value, cost follows.

Where decisions travel farther than necessary, cost multiplies.

Where risk is managed indirectly, cost expands to compensate.

What this means for large, complex organizations

For large enterprises, the implications are structural. As scale increases, hidden costs grow faster than visible ones. Without deliberate diagnostic discipline, organizations risk becoming incrementally more expensive without becoming meaningfully more capable.

Cost diagnostics, done well, provide a way to surface these dynamics before they harden. They allow leadership teams to distinguish between costs that reflect strategic choice and those that reflect accumulated indecision. In an environment where adaptability increasingly determines performance, this distinction is no longer optional.

A closing perspective

Cost will always matter. What has changed is what the cost now reveals. In stable environments, cost efficiency signalled operational discipline. In volatile ones, cost structure signals organizational health. Hidden costs are not merely financial liabilities; they are indicators of unresolved design questions.

Leaders who treat cost diagnostics as a blunt instrument will continue to chase savings that do not last. Those who treat them as a lens into how the organization truly functions may find that the most durable cost reductions come not from cutting harder, but from designing more deliberately.

______________________________________________________________________________________________________________________________

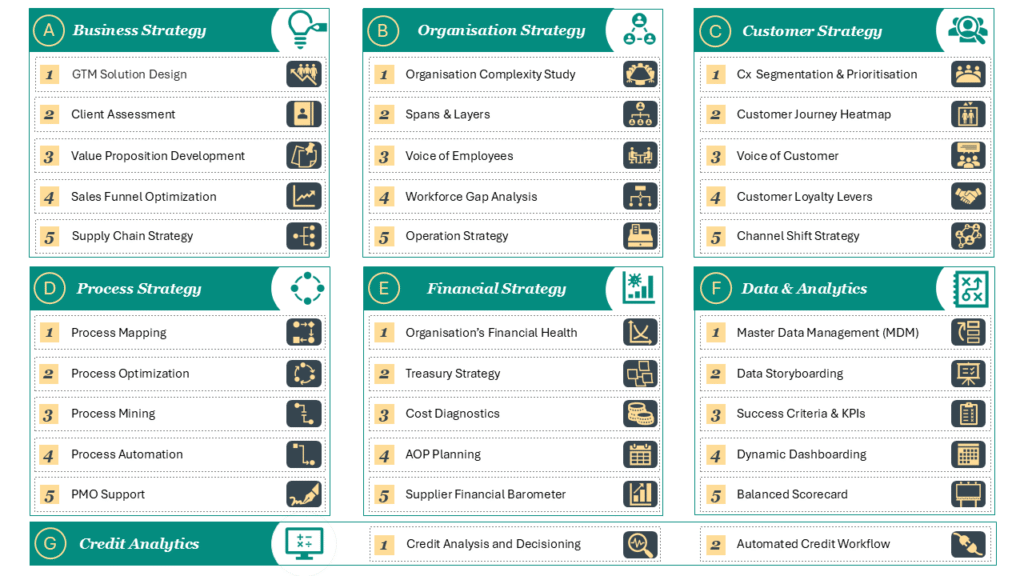

About Strategy Studio

At Strategy Studio, we help CXOs to solve complex business problems – from growth strategy and customer experience to financial transformation, process optimisation, and credit analytics. Our work blends rigorous analysis, practical execution, and deep functional expertise. To exlpore, schedule a free 30 minutes exploratory discussion HERE.

Other Articles

How to Assess Your Organization’s Financial Health for Strategic Growth

Why financial health has become a strategic constraint, not a reporting exercise Most organizations believe they understand their financial health

Designing the Liquid Enterprise – Creating Organizations That Can Reconfigure Themselves in Real Time

For years, executives have described their organizations as “agile,” “adaptive,” or “responsive.” Yet in moments of disruption, many discover

AI-Ready Strategy Teams: The 2030 Tech Stack

Most strategy teams were built for a world that no longer exists. They were designed to synthesise reports, build