Decision Systems

Designing How Critical Decisions Are Made

Strategy Studio does not offer services in isolation

We design decision systems – the explicit logic, governance, and instrumentation that determine how organisations make critical trade-offs at scale. Each decision system is built using Decision Engines™ and grounded in explainability, so decisions remain auditable, trusted, and repeatable as complexity increases

Below are the decision arenas where we embed

Growth Decisions

Growth is not a strategy problem. It is a sequence of interdependent decisions made under uncertainty

We help organisations design and govern growth decisions – clarifying where to play, how to win, and which trade-offs are acceptable as scale increases

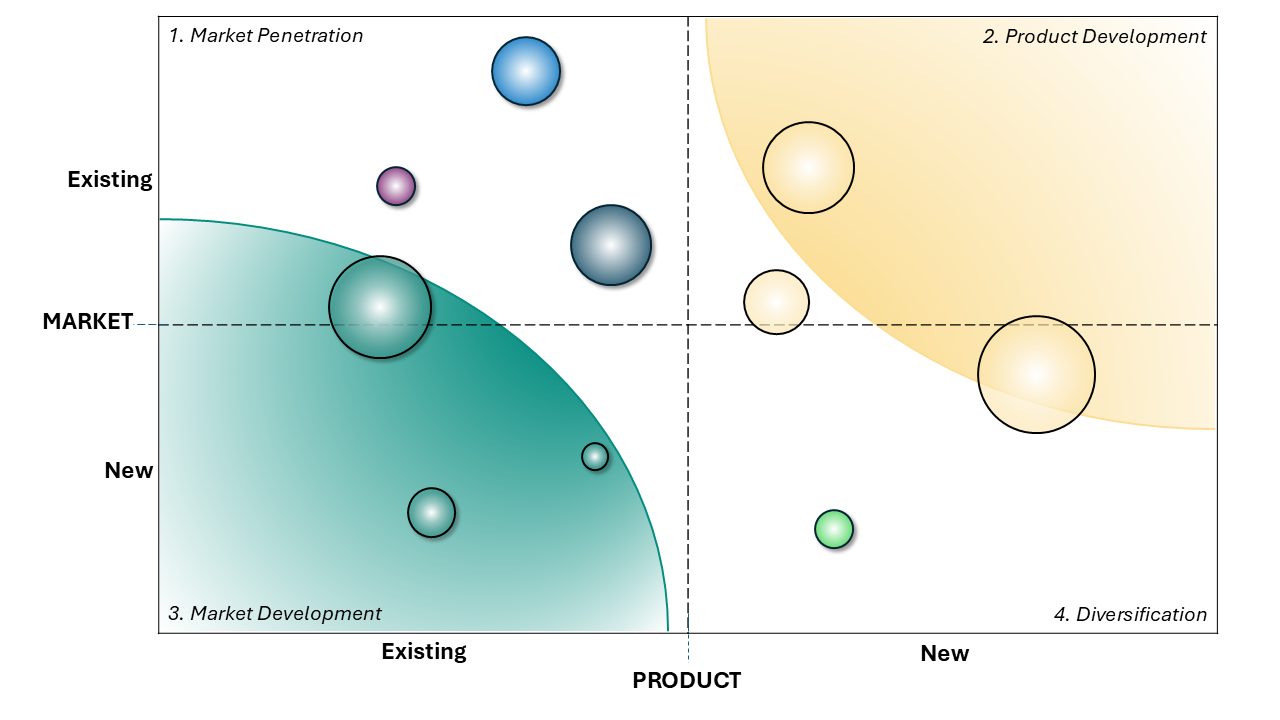

- Define explicit market entry, exit, and expansion thresholds

- Design segmentation and prioritisation rules that guide resource allocation

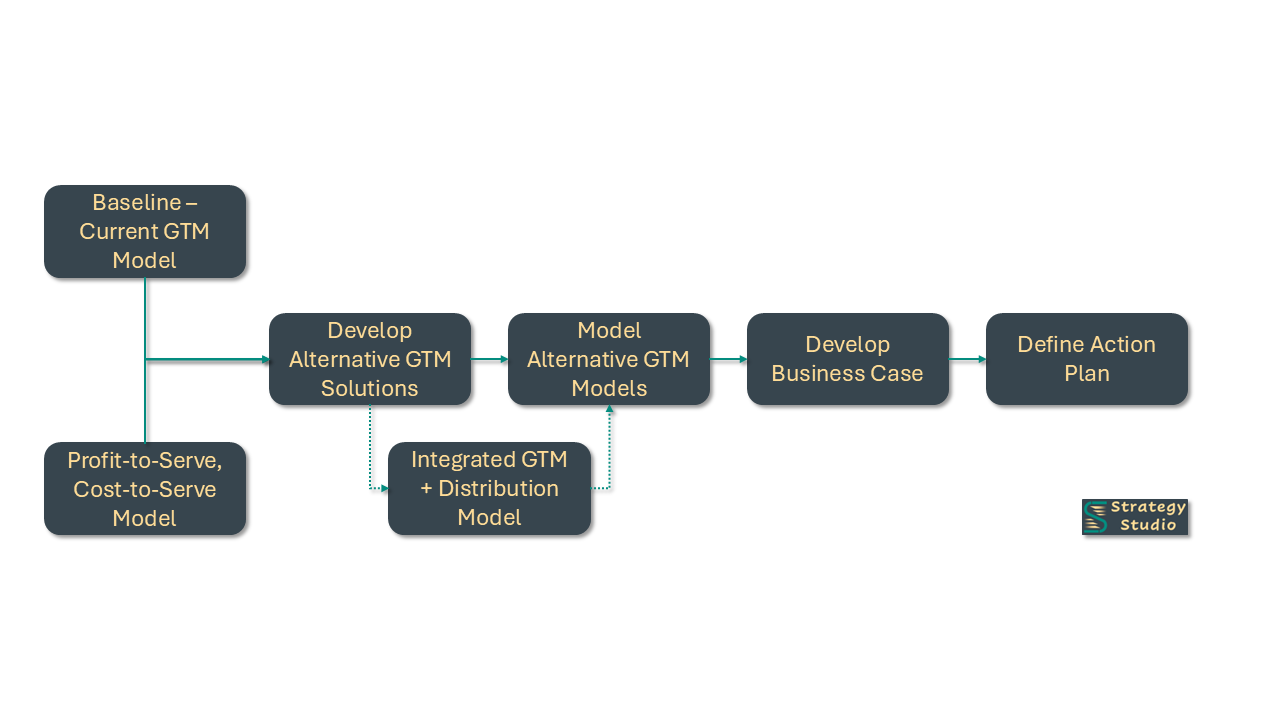

- Translate growth strategy into executable, repeatable go-to-market decisions

- Determine which customer segments warrant disproportionate focus

- Define reprioritisation and deprioritisation rules as conditions change

- Align sales and service effort with customer value, risk, and lifetime economics

- Identify which customer touchpoints are strategically non-negotiable

- Make explicit trade-offs between experience, cost-to-serve, and speed

- Distinguish actionable customer signals from noise

- Define conversion thresholds and escalation points across the funnel

- Identify structural bottlenecks limiting growth

- Instrument decisions to improve predictability, yield, and accountability

- Balance resilience, cost, and responsiveness trade-offs

- Define supplier concentration and dependency thresholds

- Govern supply-side decisions under demand volatility

Operating Model Decision

Most organisations fail not because they lack talent – but because decisions fall between roles

We design operating model decision architecture that clarifies accountability, authority, and escalation across the organisation

- Identify structural friction and decision overlaps

- Simplify reporting and accountability pathways

- Improve speed and clarity of execution

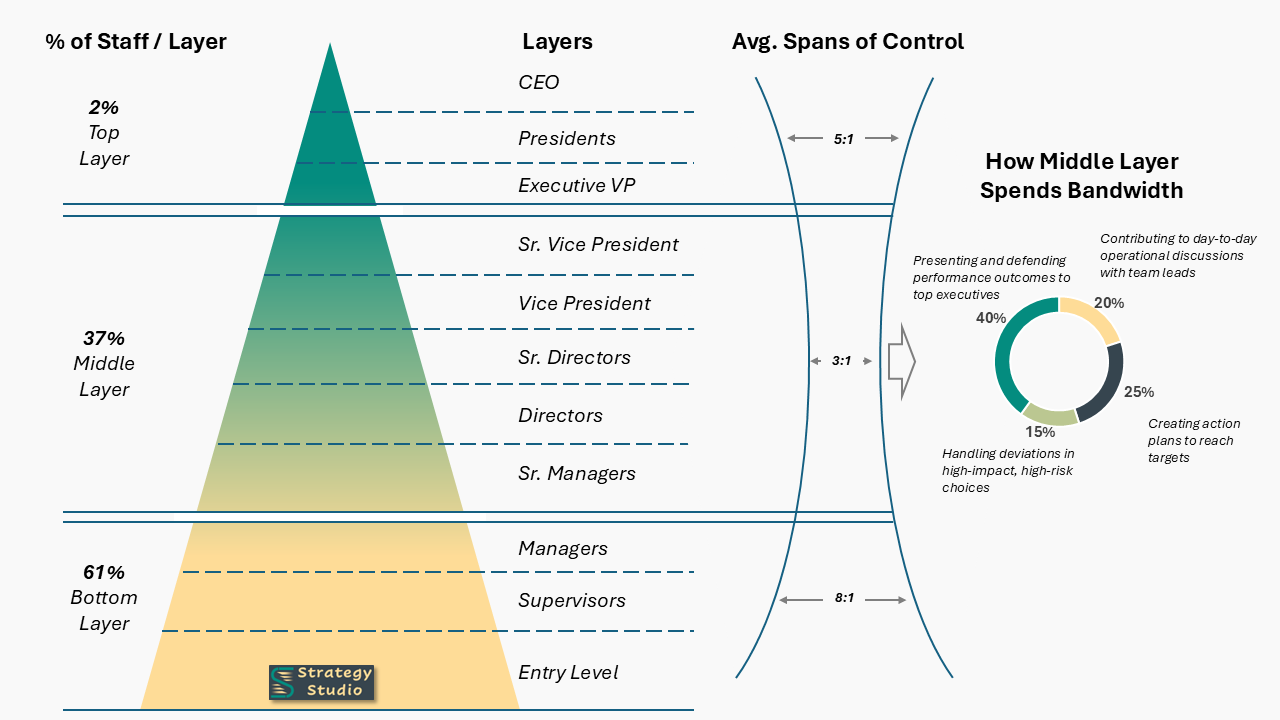

- Define optimal span thresholds for effective control

- Redesign reporting layers to improve decision velocity

- Balance managerial load with decision quality

- Convert employee feedback into actionable decision inputs

- Identify systemic issues affecting execution quality

- Align organisational decisions with lived realities

- Identify skill and capability constraints

- Design workforce investment and prioritisation logic

- Align talent decisions with strategic direction

- Clarify who owns which decisions at each organisational layer

- Define escalation triggers when decisions stall or conflict

- Prevent decision paralysis caused by ambiguity or consensus traps

Decision Rights & Control Systems

Who decides, who escalates, and who is accountable

As organisations scale, failures rarely come from lack of intent — they come from weakly governed decisions. We help leadership teams design decision rights and control systems that ensure strategy, risk, and execution remain aligned across functions, geographies, and time horizons

- Define clear decision ownership and authority models

- Eliminate ambiguity across functions and layers

- Improve speed without sacrificing control

- Design risk thresholds and escalation logic

- Align control mechanisms with real decision flows

- Reduce reliance on manual, retrospective controls

- Link decisions to accountable outcomes

- Design review cadences and governance forums

- Ensure decisions are revisited as conditions change

- Convert policies into executable decision rules

- Embed governance into operating workflows

- Reduce gap between stated intent and actual behaviour

- Design systems that are audit-friendly by default

- Improve explainability of decisions and controls

- Reduce friction between business and assurance functions

Process & Execution Decisions

Process optimisation without decision clarity only accelerates noise

We help organisations design execution decision systems – determining which processes matter, where control is required, and how exceptions should be handled

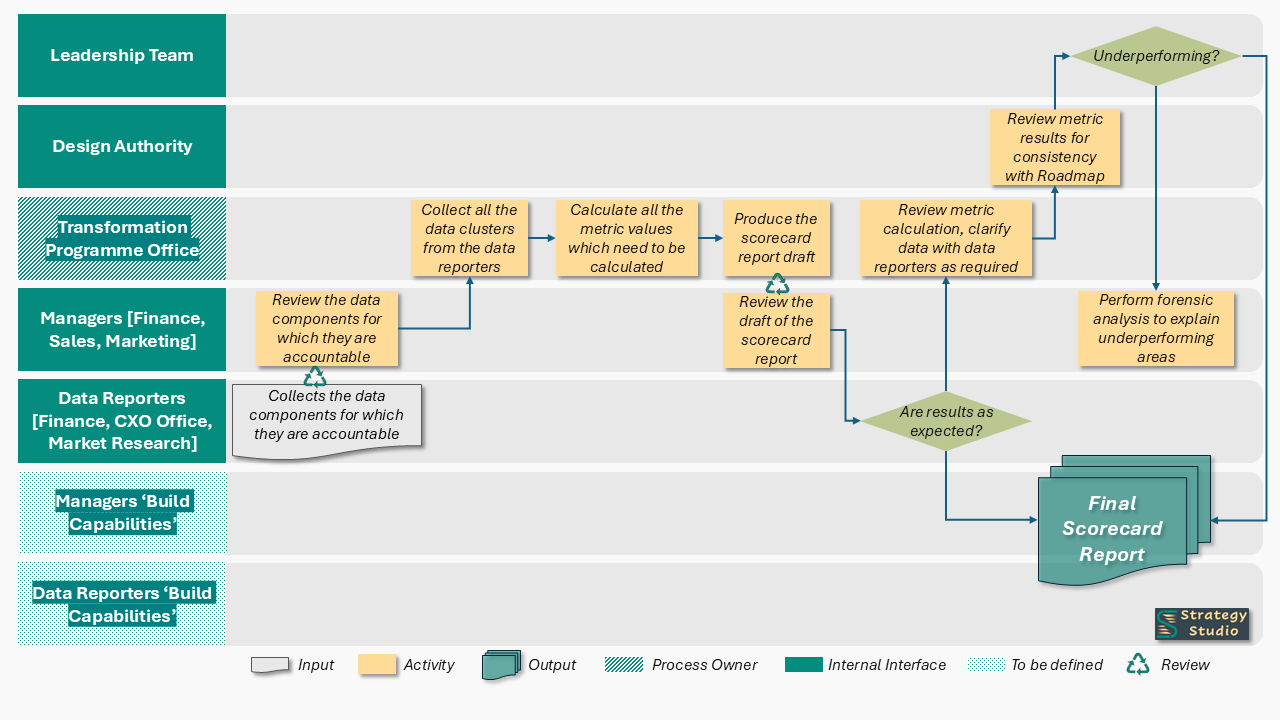

- Visualise workflows to identify decision handoffs

- Clarify ownership and control points

- Improve transparency and accountability

- Identify processes worth optimising vs ignoring

- Reduce friction and non-value-adding steps

- Improve throughput and consistency

- Analyse data to uncover execution bottlenecks

- Detect recurring exceptions and failure modes

- Inform prioritisation and redesign decisions

- Identify tasks suitable for automation

- Balance efficiency with control and explainability

- Scale execution without loss of oversight

- Design governance structures for execution discipline

- Align initiatives with strategic priorities

- Maintain momentum without project overload

Capital & Risk Decisions

Capital allocation is a decision system – not an annual ritual

We help organisations design explicit, explainable capital and risk decisions that balance growth ambition with financial discipline

- Assess balance sheet strength and exposure

- Identify structural financial risks

- Improve long-term viability and resilience

- Define liquidity thresholds and guardrails

- Design hedging and capital deployment logic

- Align treasury decisions with business strategy

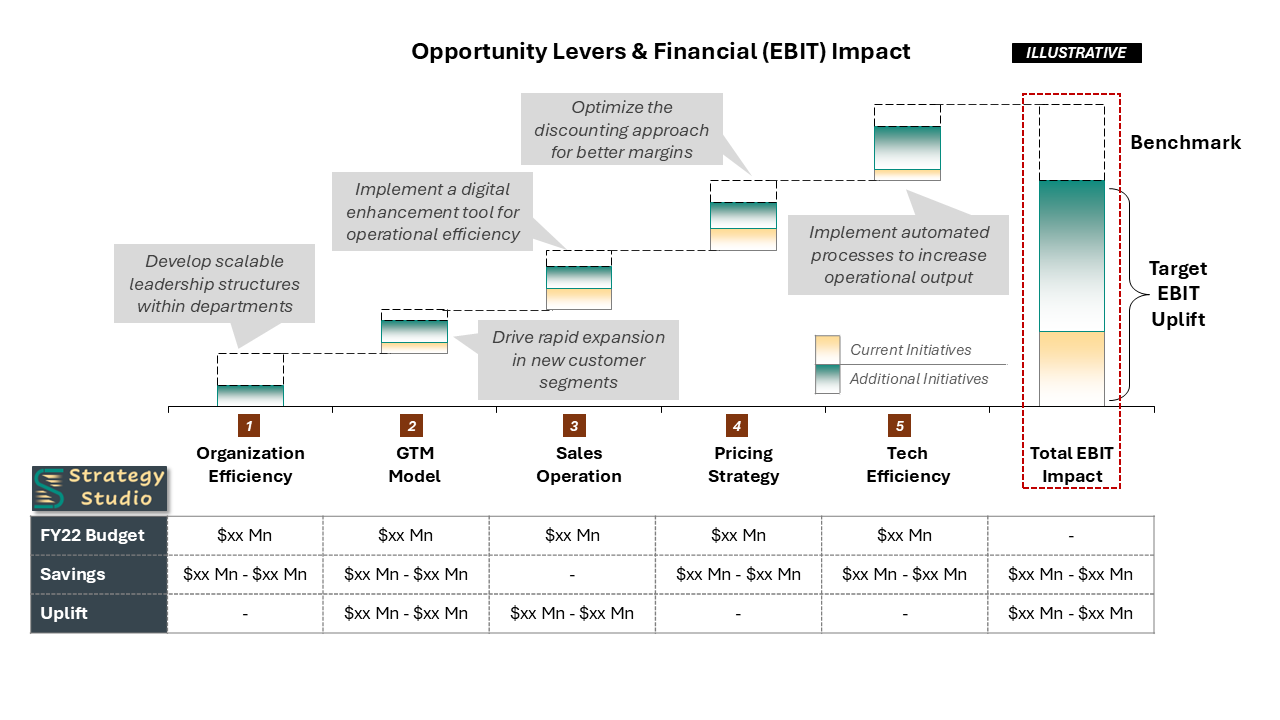

- Identify structural cost inefficiencies

- Design cost governance and escalation rules

- Improve profitability without blunt cost-cutting

- Translate strategy into capital allocation rules

- Design trade-off logic for competing priorities

- Improve predictability and discipline in planninge

- Assess financial strength of critical partners

- Define exposure and concentration thresholds

- Reduce downstream risk from supplier fragility

Credit Decisions

Credit is not a finance control. It is a strategic exposure decision

We help organisations design credit decision systems that govern how exposure is created, monitored, and corrected across customers, suppliers, and ecosystems

- Define credit approval thresholds and escalation logic

- Align credit decisions with commercial actions

- Balance speed, growth, and risk explicitly

- Design exposure limits and concentration thresholds

- Identify early-warning signals before defaults emerge

- Govern portfolio-level risk, not just individual accounts

- Embed behavioural and financial triggers

- Define intervention and remediation pathways

- Shift from reactive collections to proactive control

- Prioritise actions based on exposure and behaviour

- Define settlement and escalation thresholds

- Align recovery decisions with customer lifetime value

- Ensure credit decisions are transparent and auditable

- Reduce friction between sales, finance, and risk

- Build trust with auditors, lenders, and partners

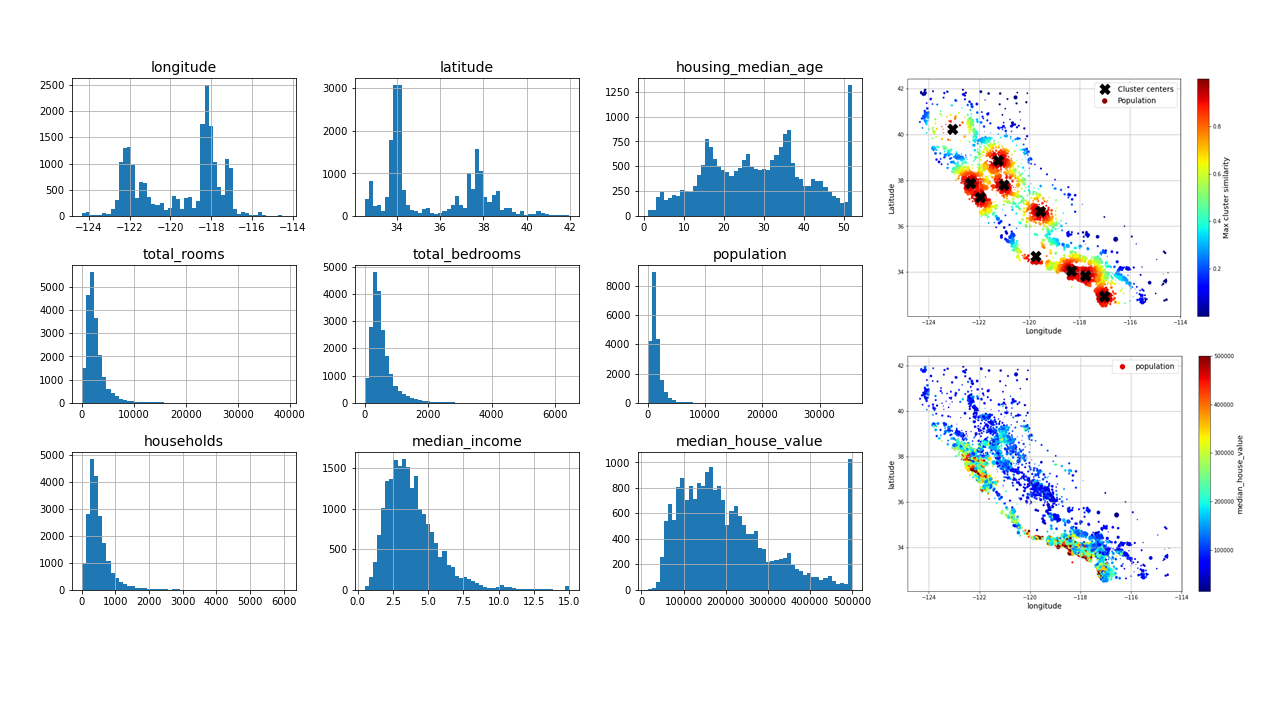

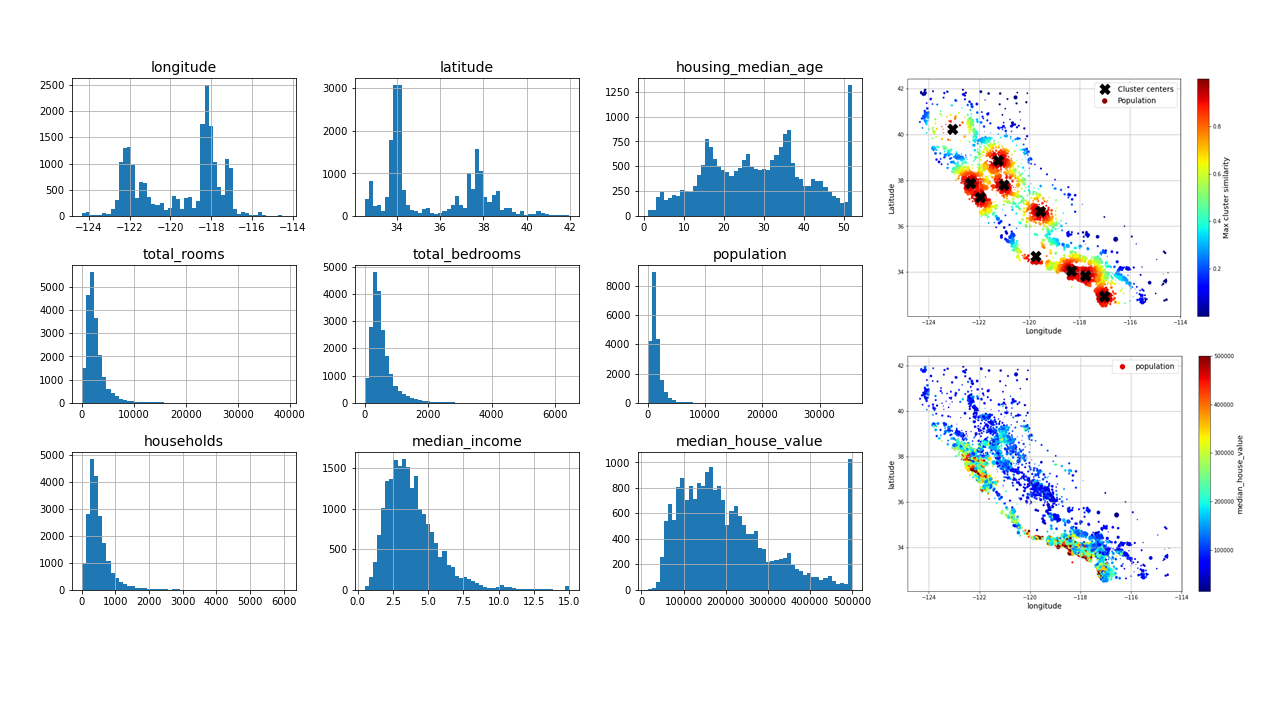

Decision Instrumentation

Data has value only when it sharpens a decision

We design decision instrumentation – signals, thresholds, and governance mechanisms – that ensure analytics serve judgment, not vanity

- Ensure consistency and reliability of decision inputs

- Define ownership and data quality thresholds

- Improve trust in enterprise data

- Translate complex analysis into decision narratives

- Make trade-offs and implications explicit

- Enable leadership alignment

- Define decision-relevant success metrics

- Establish early-warning indicators

- Align performance tracking with strategy

- Design dashboards around decisions, not metrics

- Focus on thresholds, exceptions, and signals

- Reduce noise and improve response time

- Align financial and operational objectives

- Translate strategy into governed decision logic

- Enable consistent execution across functions