In today’s rapidly shifting business environment, the pressure to reduce costs often clashes with the need to invest in growth. Cost reduction can improve short-term profitability, but sustained growth requires continual investment in innovation, talent, and new markets. Companies that strike the right balance between these two forces position themselves to navigate market uncertainties and capitalize on new opportunities. This article explores how leaders can find equilibrium between cost reduction and growth investment, drawing on real-world examples, data-driven insights, and actionable strategies.

In today’s rapidly shifting business environment, the pressure to reduce costs often clashes with the need to invest in growth. Cost reduction can improve short-term profitability, but sustained growth requires continual investment in innovation, talent, and new markets. Companies that strike the right balance between these two forces position themselves to navigate market uncertainties and capitalize on new opportunities. This article explores how leaders can find equilibrium between cost reduction and growth investment, drawing on real-world examples, data-driven insights, and actionable strategies.

Cost Reduction vs. Growth Investment Dilemma

At its core, the tension between cost reduction and growth investment lies in resource allocation. While cost reduction frees up resources for immediate use, growth investment fuels the company’s long-term sustainability and relevance.

Data Insight: According to a study by McKinsey & Company, companies that successfully manage cost reduction alongside growth initiatives report 10% higher revenue growth than their peers over a three-year period. This suggests that cost reduction alone isn’t sufficient for sustainable success; rather, balancing it with growth-focused investments yields stronger financial performance.

The Challenge of Short-Term vs. Long-Term Gains

Short-term financial pressures often push companies to prioritize cost-cutting measures, such as reducing headcount, downsizing facilities, or cutting marketing budgets. However, a sole focus on cost reduction can hinder long-term resilience, limiting the company’s ability to adapt to changing market conditions or innovate in response to emerging customer needs.

Procter & Gamble provides an example of a company that learned to balance cost reduction with growth investment effectively. During the 2008 financial crisis, P&G implemented cost-cutting initiatives by consolidating its manufacturing footprint and streamlining its product lines. Yet, instead of sacrificing innovation, P&G reinvested the savings into research and development (R&D) and marketing. This approach enabled the company to emerge from the recession with a streamlined operation and strong brand positioning, leading to sustainable growth in subsequent years.

Procter & Gamble provides an example of a company that learned to balance cost reduction with growth investment effectively. During the 2008 financial crisis, P&G implemented cost-cutting initiatives by consolidating its manufacturing footprint and streamlining its product lines. Yet, instead of sacrificing innovation, P&G reinvested the savings into research and development (R&D) and marketing. This approach enabled the company to emerge from the recession with a streamlined operation and strong brand positioning, leading to sustainable growth in subsequent years.

Key Considerations for Cost Reduction

Effective cost reduction strategies are those that minimize waste and improve efficiency without sacrificing quality or future potential. Here are three principles to guide cost-cutting decisions:

Principle 1: Identify Low-Impact Costs

Identify and reduce expenses that don’t contribute directly to strategic objectives. Administrative costs, outdated legacy systems, or underperforming assets are often prime candidates for reduction.

When General Electric (GE) restructured its business, it divested non-core business units that were not central to its long-term strategy. By reallocating these resources, GE was able to focus on areas with higher growth potential, such as renewable energy and healthcare.

Principle 2: Leverage Technology to Drive Efficiency

Automation and digital tools can yield substantial savings. For instance, implementing automation in routine tasks not only reduces costs but also frees up talent for high-value activities. According to Deloitte, companies that embrace automation report an average cost reduction of 20% in administrative functions.

Principle 3: Avoid Sacrificing Value-Adding Capabilities

While cost reduction can create short-term savings, leaders must ensure that cuts do not impact the organization’s core competencies or customer satisfaction. An effective approach is to prioritize cuts in non-value-adding activities, thereby safeguarding the customer experience and operational integrity.

Investing in growth: Identifying high-impact opportunities

Balancing cost reduction with growth requires targeted investments in areas with high potential for long-term returns. Here are key areas where strategic investment can foster sustainable growth:

Target 1: Innovation and Product Development

Investing in R&D is essential for companies seeking to stay ahead of competitors. Research by Boston Consulting Group (BCG) found that companies that consistently invest in R&D grow their revenues at twice the rate of those that don’t. Product development allows companies to meet evolving customer demands, capture new markets, and drive revenue growth.

Target 2: Talent Development and Acquisition

Investing in a skilled workforce contributes directly to productivity, innovation, and competitive advantage. Particularly in industries with rapid technological advancements, talent development is a high-impact investment. Companies that prioritize talent, even during economic downturns, typically outperform peers who cut training and development budgets.

Data Insight: A study by LinkedIn revealed that companies investing in talent development report 34% higher employee retention rates and attract top talent faster, reducing future recruitment costs.

Target 3: Digital Transformation and Market Expansion

Digital tools enable organizations to tap into new markets, optimize operations, and respond swiftly to changing customer expectations. For instance, Nike’s digital strategy to integrate e-commerce, data analytics, and supply chain management allowed it to increase direct-to-consumer sales by 50% over three years. This digital shift not only expanded Nike’s reach but also strengthened its brand positioning in global markets.

Strategies for Balancing

Leaders must develop a strategic approach that combines disciplined cost management with selective growth investments. Here are three strategies to achieve this balance:

Strategy 1: Implement a Zero-Based Budgeting Approach

Zero-based budgeting (ZBB) requires each department to justify its budget from scratch, ensuring that only essential and growth-oriented activities receive funding. By adopting ZBB, companies can align their spending with current priorities, directing savings towards high-growth initiatives.

Kraft Heinz used ZBB to reduce its operational costs and free up resources for product innovation. This approach allowed Kraft Heinz to invest in new product lines that catered to health-conscious consumers, aligning with evolving customer preferences.

Kraft Heinz used ZBB to reduce its operational costs and free up resources for product innovation. This approach allowed Kraft Heinz to invest in new product lines that catered to health-conscious consumers, aligning with evolving customer preferences.

Strategy 2: Conduct Regular Portfolio Reviews

A regular review of the project and product portfolio enables organizations to identify underperforming projects, reallocate resources, and prioritize high-potential initiatives. Portfolio reviews help ensure that cost reduction efforts do not stifle innovation by re-directing funds toward strategically important areas.

Strategy 3: Adopt Agile Practices for Financial Flexibility

Agility is essential for dynamically adjusting budgets and resource allocation based on real-time performance. Agile financial management allows companies to reallocate budgets quickly to respond to market changes, ensuring that resources are consistently aligned with strategic priorities.

Metrics for Monitoring

To maintain the right balance, companies should track metrics that reflect both short-term cost efficiency and long-term growth potential. Key metrics include:

- Cost-to-Revenue Ratio: Measures operational efficiency by comparing costs to generated revenue. A lower ratio indicates effective cost management without compromising revenue.

- Return on Investment (ROI): Tracks the financial return from growth initiatives, allowing leaders to assess the impact of investments on profitability.

- Operating Margin: Provides insight into profitability after accounting for both cost reduction and investment expenses. An increasing operating margin indicates improved financial health and efficient resource allocation.

- Customer Acquisition Cost (CAC): Measures the cost of acquiring new customers. Lower CAC reflects efficient marketing and sales investments, contributing to sustainable growth.

- Revenue Growth Rate: Reflects the success of growth investments in driving top-line growth. A steady increase signals effective long-term investment.

Overcoming challenges

Balancing cost-cutting measures with growth-focused investments presents unique challenges. Here are common obstacles and solutions:

Challenge 1: Short-Term Pressures from Stakeholders

External pressures from stakeholders often drive companies to prioritize immediate cost savings. Leaders can address this by communicating the long-term value of growth investments and demonstrating how strategic investments today yield sustainable profitability.

Challenge 2: Risk of Innovation Stagnation

Cost reductions can inadvertently impact innovation when budget cuts target R&D or talent development. To mitigate this, companies should earmark a portion of savings specifically for innovation, ensuring critical growth areas remain funded.

Challenge 3: Aligning Organizational Culture with Balanced Priorities

Achieving buy-in from teams requires cultivating a culture that values both cost efficiency and growth. Transparent communication on how each strategy contributes to organizational success can help foster alignment.

Building resilience through balanced resource allocation

Balancing cost reduction with growth investment is essential for companies aiming to build resilience and competitive advantage in today’s dynamic market. An effective approach emphasizes targeted cost-cutting in low-impact areas while prioritizing investments in high-growth, high-impact initiatives like innovation, talent, and digital transformation. By regularly monitoring relevant metrics, organizations can adjust their strategies to maintain equilibrium between efficiency and growth.

Ultimately, the most successful companies are those that view cost reduction and growth investment not as competing priorities, but as complementary levers that, when balanced effectively, drive long-term profitability and adaptability. In a business landscape marked by disruption, finding this balance is not just a strategy; it’s a competitive necessity.

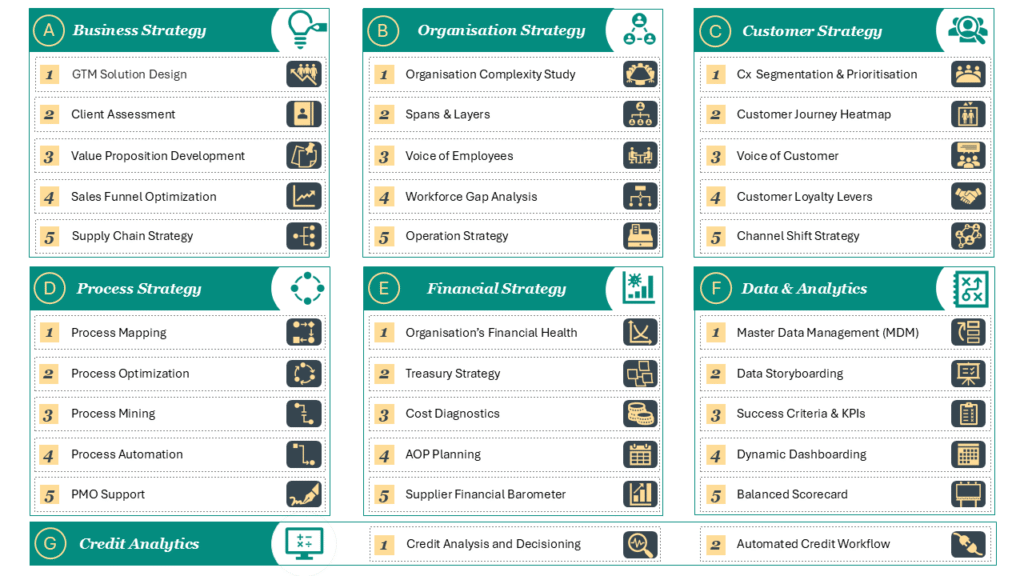

About Strategy Studio

At Strategy Studio, we help CXOs to solve complex business problems – from growth strategy and customer experience to financial transformation, process optimisation, and credit analytics. Our work blends rigorous analysis, practical execution, and deep functional expertise. To exlpore, schedule a free 30 minutes exploratory discussion HERE.

Other Articles

How to Assess Your Organization’s Financial Health for Strategic Growth

Why financial health has become a strategic constraint, not a reporting exercise Most organizations believe they understand their financial health

Cost Diagnostics: Identifying and Reducing Hidden Costs

Cost has returned to the centre of boardroom conversations, but not for the reasons many leaders assume. This is

Designing the Liquid Enterprise – Creating Organizations That Can Reconfigure Themselves in Real Time

For years, executives have described their organizations as “agile,” “adaptive,” or “responsive.” Yet in moments of disruption, many discover